overview of DnBitcoin

description::

Bitcoin

Refers to a protocol, network or a unit of currency.

As a protocol, Bitcoin is a set of rules that every client must follow to accept transactions and have its own transactions accepted by other clients. Also includes a message protocol that allows nodes to connect to each other and exchange transactions and blocks.

As a network, Bitcoin is all the computers that follow the same rules and exchange transactions and blocks between each other.

As a unit, one Bitcoin (BTC, XBT) is defined as 100 million satoshis, the smallest units available in the current transaction format. Bitcoin is not capitalized when speaking about the amount: "I received 0.4 bitcoins."

[https://github.com/oleganza/bitcoin-papers/blob/master/BitcoinGlossary.md#bitcoin]

name::

* McsEngl.McsTchInf000017.last.html//dirTchInf//dirMcs!⇒DnBitcoin,

* McsEngl.dirMcs/dirTchInf/McsTchInf000017.last.html!⇒DnBitcoin,

* McsEngl.Bitcoin!⇒DnBitcoin,

* McsEngl.Bitcoin-ecosystem!⇒DnBitcoin,

* McsEngl.Bitcoin-Electronic-Cash-System!⇒DnBitcoin, [Nakamoto 2008]

* McsEngl.Bitcoin-financial-network!⇒DnBitcoin,

* McsEngl.Bitcoin-network!⇒DnBitcoin,

* McsEngl.Bitcoin-net!⇒DnBitcoin, {2019-02-25},

* McsEngl.Bitcoin-payment-system!⇒DnBitcoin,

* McsEngl.Bitcoin-Peer-to-Peer-Electronic-Cash-System!⇒DnBitcoin, [Nakamoto]

* McsEngl.Bitcoin-peer-to-peer-network!⇒DnBitcoin,

* McsEngl.Bitcoin-system!⇒DnBitcoin,

* McsEngl.Bitcoinland!⇒DnBitcoin,

* McsEngl.D-stroke-Bitcoin-network!⇒DnBitcoin,

* McsEngl.DnBitcoin, {2019-06-18},

* McsEngl.DnBitcoin!=McsTchInf000017,

* McsEngl.DnBitcoin!=Bitocoin-blockchain-net,

* McsEngl.netBitcoin!⇒DnBitcoin,

* McsEngl.networkBitcoin!⇒DnBitcoin,

* McsEngl.Đ-Bitcoin!⇒DnBitcoin,

* McsEngl.Đ-btc!⇒DnBitcoin,

* McsEngl.ĐBitcoin!⇒DnBitcoin,

======

* Bitcoin is the first financial network that exhibits the characteristics of neutrality,

[https://www.cryptocoinsnews.com/bitcoin-evangelist-antonopoulos-in-barcelona-thoughts-on-the-future-of-money/]

description::

Bitcoin represents the culmination of decades of research in cryptography and distributed systems and includes four key innovations brought together in a unique and powerful combination.

Bitcoin consists of:

A decentralized peer-to-peer network (the bitcoin protocol)

A public transaction ledger (the blockchain)

A decentralized mathematical and deterministic currency issuance (distributed mining)

A decentralized transaction verification system (transaction script)

[https://github.com/aantonop/bitcoinbook/blob/develop/ch01.asciidoc]

description::

Bitcoin is two things which share a name: 1) a payment system and 2) a currency. You use the Bitcoin payment system to send bitcoins as currency from one account holder to another. The transfer is instantaneous, carries no necessary fee, works anywhere in the world, and is private.

[http://keepyourassets.net/2012/09/27/bitcoin-the-first-five-questions/]

Bitcoin is also the name of the open source software which enables the use of this currency.

[http://bitcoin.org/] 2012-05-27,

description::

Connect to the world’s first borderless payment network - Bitcoin.

[https://bitpay.com/tour]

description::

Bitcoin is a decentralized P2P electronic cash system without a central server or trusted parties. Users hold the crypto keys to their own money and transact directly with each other, with the help of the network to check for double-spending.

[http://sourceforge.net/projects/bitcoin/] 2013-03-18

description::

Just like the Internet, Bitcoin is not a corporation and does not have a CEO.

[http://www.givebtc.org/GiveBTC_-_Handbook_for_Non_Profits.pdf]

description::

Bitcoin uses a simple broadcast network to propagate transactions and blocks. All communications are done over TCP. Bitcoin is fully able to use ports other than 8333 via the -port parameter. IPv6 is suported with Bitcoind/Bitcoin-Qt v0.7.

[https://en.bitcoin.it/wiki/Network]

description::

A decentralized peer-to-peer network (the bitcoin protocol)

[https://github.com/aantonop/bitcoinbook/blob/develop/ch01.asciidoc]

description::

Behind the scenes, bitcoin is also the name of the protocol, a network, and a distributed computing innovation.

[https://github.com/aantonop/bitcoinbook/blob/develop/ch01.asciidoc]

generic::

* blockchain-network,

attribute of DnBitcoin

name::

* McsEngl.DnBitcoin'attribute.Indexed,

* McsEngl.DnBitcoin'glossary,

* McsEngl.DnBitcoin'vocabulary,

specific::

* Bitcoin Wiki: https://en.bitcoin.it/wiki/Vocabulary,

* Coindesk: http://www.coindesk.com/information/bitcoin-glossary/,

* Oleg Andreev: https://github.com/oleganza/bitcoin-papers/blob/master/BitcoinGlossary.md,

===

* btcBare_multisig

* btcChild_private_key

* btcChild_public_key

* btcCompressed_public_key

* btcConfirmation_score

* btcData_carrier_transaction

* btcData_pushing_op_code

* btcDNS_seed

* btcEscrow_contract

* btcExtended_key

* btcFree_transaction

* btcHardened_extended_key

* btcHeader

* btcHeader_chain

* btcHeaders_first_sync

* btcHigh_priority_transaction

* btcIBD

* btcInitial_block_download

* btcInternal_byte_order

* btcInventory

* btcMajority_attack

* btcMaster_chain_code

* btcMaster_private_key

* btcMerkle_block

* btcMerkle_root

* btcMessage_header

* btcMiners_fee

* btcMinimum_relay_fee

* btcMultisig

* btcNetwork_magic

* btcnLockTime

* btcNon_data_pushing_op_code

* btcNull_data_transaction

* btcOP_RETURN_transaction

* btcOrphan_block

* btcOutpoint

* btcP2P_protocol_messages

* btcP2PKH_address

* btcP2PKH_output

* btcP2SH_address

* btcP2SH_multisig

* btcP2SH_output

* btcParent_key

* btcParent_private_key

* btcParent_public_key

* btcPayment_protocol

* btcPayment_request

* btcPOWPrivate_extended_keyPrivate_key

* btcPublic_extended_key

* btcBitcoin_Core_RPCs

* btcRaw_transaction

* btcRedeem_script

* btcRedeemScript

* btcRegression_test_mode

* btcRegtest

* btcRelay_fee

* btcRPC_byte_order

* btcSatoshis

* btcScriptPubKey

* btcSig

* btcSequence_number

* btcSerialized_block

* btcSerialized_transaction

* btcSighash

* btcSIGHASH_ALL

* btcSIGHASH_ANYONECANPAY

* btcSIGHASH_NONE

* btcSIGHASH_SINGLE

* btcSignature

* btcSignature_hash

* btcStale_block

* btcStart_string

* btcTransaction_malleability

* btcTransaction_mutability

* btcTxid

* btcWallet_Import_Format

* btcWatch_only_address

* btcWIF

Bitcoin-att.Oleg-Adreev

description::

Glossary is made by Oleg Andreev (oleganza@gmail.com).

Twitter: @oleganza.

Send your thanks here: 1CBtcGivXmHQ8ZqdPgeMfcpQNJrqTrSAcG.

This glossary is released under WTFPL.

Do what you want with it, but I would appreciate if you give full credit in case you republish it.

Please report any mistakes or create pull requests on Github.

Contributors will be listed here. Thanks!

Some unusual terms are frequently used in Bitcoin documentation and discussions like *tx* or *coinbase*.

Or words like *scriptPubKey* were badly chosen and now deserve some extra explanation.

This glossary will help you understand exact meaning of all Bitcoin-related terms.

[https://github.com/oleganza/bitcoin-papers/blob/master/BitcoinGlossary.md]

name::

* McsEngl.DnBitcoin'glossary.Oleg-Adreev,

* McsEngl.DnBitcoin'Oleg-Adreev-glossary,

btc-ASIC:

Stands for "application-specific integrated circuit".

In other words, a chip designed to perform a narrow set of tasks (compared to CPU or GPU that perform a wide range of functions).

ASIC typically refers to specialized *mining* chips or the whole machines built on these chips.

Some ASIC manufacturers: Avalon, ASICMiner, Butterfly Labs (BFL) and Cointerra.

btc-ASICMiner:

A Chinese manufacturer that makes custom mining hardware, sells shares for bitcoins, pays dividends from on-site mining and also ships actual hardware to customers.

btc-Bitcoin_ruby:

A Bitcoin utilities library in Ruby by Julian Langschaedel.

Used in production on *Coinbase.com*.

btc-Casascious_Coins:

Physical collectible coins produced by Mike Caldwell. Each coin contains a *private key* under a tamper-evident hologram. The name "Casascius" is formed from a phrase "call a spade a spade", as a response to a name of Bitcoin itself.

btc-Coin:

An informal term that means either 1 bitcoin, or an unspent *transaction output* that can be *spent*.

btc-Coinbase.com:

US-based Bitcoin/USD exchange and web wallet service.

btc-Key:

Could mean an ECDSA public or private key, or AES symmetric encryption key.

AES is not used in the protocol itself (only to encrypt the ECDSA keys and other sensitive data), so usually the word *key* means an ECDSA key.

When talking about *keys*, people usually mean private keys as public key can always be derived from a private one.

See also Private Key and *Public Key*.

btc-Main_Chain:

A part of the blockchain which a node considers the most difficult (see difficulty).

All nodes store all valid blocks, including orphans and recompute the total difficulty when receiving another block.

If the newly arrived block or blocks do not extend existing main chain, but create another one from some previous block, it is called *reorganization*.

btc-Miner:

A person, a software or a hardware that performs mining.

btc-Secret_key:

Either the *Private Key* or an encryption key used in encrypted *wallets*.

Bitcoin protocol does not use encryption anywhere, so *secret key* typically means a *private key* used for signing transactions.

Incorrect peer-to-peer messages (like sending invalid transactions) may be considered a denial of service attack (see *DoS*).

Valid transactions sending very tiny amounts and/or having low *mining fees* are called Dust by some people.

The protocol itself does not define which transactions are not worth relaying or mining, it's a decision of every individual node.

Any valid transaction in the blockchain must be accepted by the node if it wishes to accept the remaining blocks, so transaction censorship only means increased confirmation delays.

Individual payees may also blacklist certain addresses (refuse to accept payments from some addresses), but that's too easy to work around using *mixing*.

VarInt:

This term may cause confusion as it means different formats in different Bitcoin implementations. See *CompactSize* for details.

Bitcoin-att.Coindesk

description::

CoinDesk is the world leader in news and information on digital currencies such as bitcoin, and its underlying technology – the blockchain.

We cover news and analysis on the trends, price movements, technologies, companies and people in the bitcoin and digital currency world.

[http://www.coindesk.com/about-us/]

name::

* McsEngl.DnBitcoin'glossary.Coindesk,

* McsEngl.DnBitcoin'Coindesk-glossary,

addressWpg::

* http://www.coindesk.com/information/bitcoin-glossary/,

btc-AML:

Anti-Money Laundering techniques are used to stop people converting illegally obtained funds, to appear as though they have been earned legally.

AML mechanisms can be legal or technical in nature.

Regulators frequently apply AML techniques to bitcoin exchanges.

btc-ASIC:

An Application Specific Integrated Circuit is a silicon chip specifically designed to do a single task.

In the case of bitcoin, they are designed to process SHA-256 hashing problems to mine new bitcoins.

btc-ASIC_miner:

A piece of equipment containing an ASIC chip, configured to mine for bitcoins.

They can come in the form of boards that plug into a backplane, devices with a USB connector, or standalone devices including all of the necessary software, that connect to a network via a wireless link or ethernet cable.

btc-Bitcoin_Investment_Trust:

This private, open-ended trust invests exclusively in bitcoins and uses a state-of-the-art protocol to store them safely on behalf of its shareholders.

It provides a way for people to invest in bitcoin without having to purchase and safely store the digital currency themselves.

btc-Bitcoin_Sentiment_Index, btcBSI:

The Bitcoin Sentiment Index is a measure of whether individuals feel the digital currency's prospects are increasing or decreasing on any given day, and is powered by data collected by Qriously.

btc-Bitcoin_Market_Potential_Index, btcBMPI:

The Bitcoin Market Potential Index (BMPI) uses a data set to rank the potential utility of bitcoin across 177 countries.

It attempts to show which markets have the greatest potential for bitcoin adoption.

btc-Bitcoin_Price_Index, btcBPI:

The CoinDesk Bitcoin Price Index represents an average of bitcoin prices across leading global exchanges that meet criteria specified by the BPI.

There is also an API for developers to use.

btc-BitPay:

A payment processor for bitcoins, which works with merchants, enabling them to take bitcoins as payment.

btc-Buttonwood:

A project founded by bitcoin enthusiast Josh Rossi, to form a public outcry bitcoin exchange in New York's Union Square.

Named after the Buttonwood agreement, which formed the basis for the New York Stock Exchange in 1792.

btc-Circle:

Circle is an exchange and wallet service, offering users worldwide the chance to store, send, receive and exchange bitcoins.

btc-Coin_age:

The age of a coin, defined as the currency amount multiplied by the holding period.

btc-DDoS:

A distributed denial of service attack uses large numbers of computers under an attacker’s control to drain the resources of a central target.

They often send small amounts of network traffic across the Internet to tie up computing and bandwidth resources at the target, which prevents it from providing services to legitimate users.

Bitcoin exchanges have sometimes been hit with DDoS attacks.

btc-Deflation:

The reduction of prices in an economy over time.

It happens when the supply of a good or service increases faster than the supply of money, or when the supply of money is finite, and decreases.

This leads to more goods or services per unit of currency, meaning that less currency is needed to purchase them.

This carries some downsides.

When people expect prices to fall, it causes them to stop spending and hoard money, in the hope that their money will go further later.

This can depress an economy.

btc-Escrow:

The act of holding funds or assets in a third-party account to protect them during an asynchronous transaction.

If Bob wants to send money to Alice in exchange for a file, but they cannot conduct the exchange in person, then how can they trust each other to send the money and file to each other at the same time?

Instead, Bob sends the money to Eve, a trusted party who holds the funds until Bob confirms that he has received the file from Alice.

She then sends Alice the money.

btc-Faucent:

A technique used when first launching an altcoin.

A set number of coins are pre-mined, and given away for free, to encourage people to take interest in the coin and begin mining it themselves.

btc-Fiat_currency:

A currency, conjured out of thin air, which only has value because people say it does.

Constantly under close scrutiny by regulators due to its known application in money laundering and terrorist activities.

Not to be confused with bitcoin.

btc-FinCEN:

The Financial Crimes Enforcement Network, an agency within the US Treasury Department.

FinCEN has thus far been the main organization to impose regulations on exchanges trading in bitcoin.

btc-FPGA:

A Field Programmable Gate Array is a processing chip that can be configured with custom functions after it has been fabricated.

Think of it as a blank silicon slate on which instructions can be written.

Because FPGAs can be produced en masse and configured after fabrication, manufacturers benefit from economies of scale, making them cheaper than ASIC chips.

However, they are usually far slower.

btc-GPU:

Graphical Processing Unit.

A silicon chip specifically designed for the complex mathematical calculations needed to render millions of polygons in modern computer game graphics.

They are also well suited to the cryptographic calculations needed in cryptocurrency mining.

btc-Inflation:

When the value of money drops over time, causing prices for goods to increase.

The result is a drop in purchasing power.

Effects include less motivation to hoard money, and more motivation to spend it quickly while the prices of goods are still low.

btc-KYC:

Know Your Client/Customer rules force financial institutions to vet the people they are doing business with, ensuring that they are legitimate.

btc-Leverage, btcMargin_requirement:

In foreign currency trading, leverage multiplies the real funds in your account by a given factor, enabling you to make trades that result in significant profit.

By giving leverage to a trader, the trading exchange is effectively lending them money, in the hope that it will earn back more than it loaned in commission.

Leverage is also known as a margin requirement.

btc-Liberty_Reserve:

A centralized digital currency payment processor based in Costa Rica.

It was shut down by the US government, after it was found guilty of money laundering.

btc-Liquidity:

The ability to buy and sell an asset easily, with pricing that stays roughly similar between trades.

A suitably large community of buyers and sellers is important for liquidity.

The result of an illiquid market is price volatility, and the inability to easily determine the value of an asset.

btc-Margin_call:

The act of calling in a margin requirement.

An exchange will issue a margin call when it feels that a trader does not have sufficient funds to cover a leveraged trading position.

btc-Market_order:

An instruction given to an exchange, asking it to buy or sell an asset at the going market rate.

In a bitcoin exchange, you would place a market order if you simply wanted to buy or sell bitcoins immediately, rather than holding them until a set market condition is triggered to try and make a profit.

btc-P2P:

Peer-to-peer.

Decentralized interactions that happen between at least two parties in a highly interconnected network.

An alternative system to a 'hub-and-spoke' arrangement, in which all participants in a transaction deal with each other through a single mediation point.

btc-Primecoin

Developed by Sunny King, Primecoin uses a proof of work system to calculate prime numbers.

btc-PSP:

Payment Service Provider.

The PSP offers payment processing services for merchants who wish to accept payments online.

btc-Pump_and_dump:

Inflating the value of a financial asset that has been produced or acquired cheaply, using aggressive publicity and often misleading statements.

The publicity causes others to acquire the asset, forcing up its value.

When the value is high enough, the perpetrator sells their assets, cashing in and flooding the market, which causes the value to crash.

btc-Silk_Road:

An underground online marketplace, generally used for illicit purchases, often with cryptocurrencies such as bitcoin.

Silk Road was shut down in early October 2013 by the FBI after owner Ross Ulbricht was arrested.

Ulbricht was later convicted on money laundering and drug distribution charges.

btc-SEPA:

The Single European Payments Area.

A payment integration agreement within the European Union, designed to make it easier to transfer funds between different banks and nations in euros.

btc-TOR:

An anonymous routing protocol, used by people wanting to hide their identity online.

btc-Volatility:

The measurement of price movements over time for a traded financial asset (including bitcoin).

btc-Wire_transfer:

Electronically transferring money from one person to another.

Commonly used to send and retrieve fiat currency from bitcoin exchanges.

btc-Zerocoin:

A protocol designed to make cryptocurrency transactions truly anonymous.

protocol of DnBitcoin

name::

* McsEngl.Bitcoin-protocol!⇒Bitcoin-prcl,

* McsEngl.DnBitcoin'message-protocol!⇒Bitcoin-prcl,

* McsEngl.DnBitcoin'protocol!⇒Bitcoin-prcl,

* McsEngl.Bitcoin-prcl, {2019-03-17},

name.Greek::

* McsElln.Μπιτκόιν-πρωτόκολλο,

* McsElln.Πρωτόκολλο-μπιτκόιν,

generic::

* blockchain-protocol,

Bitcoin-prcl'white-paper {2008}

description::

The bitcoin whitepaper was written by ‘Satoshi Nakamoto’ and posted to a Cryptography Mailing list in 2008.

The paper describes the bitcoin protocol in detail, and is well worth a read.

Satoshi Nakamoto followed this by releasing the bitcoin code in 2009.

...

In November 2008, a paper, authored (probably pseudonymously) by Satoshi Nakamoto, was posted on the newly created Bitcoin.org website with the title ‘Bitcoin: A Peer-to-Peer Electronic Cash System’.

The eight-page document described methods of using a peer-to-peer network to generate "a system for electronic transactions without relying on trust" and laid down the working principles of the cryptocurrency.

[http://www.coindesk.com/information/bitcoin-glossary/]

name::

* McsEngl.white-paper--of--Bitcoin-network,

* McsEngl.DnBitcoin'white-paper,

* McsEngl.Bitcoin-wpr-(Bitcoin-white-paper),

name.Greek::

* McsElln.Λευκή-βίβλος-του-μπτικόιν,

addressWpg::

* https://bitcoin.org/bitcoin.pdf,

* http://www.cryptovest.co.uk/resources/Bitcoin%20paper%20Original.pdf,

Bitcoin: A Peer-to-Peer Electronic Cash System

Satoshi Nakamoto

www.bitcoin.org

{2008-10-31},

Abstract

A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution.

Digital signatures provide part of the solution, but the main benefits are lost if a trusted third party is still required to prevent double-spending.

We propose a solution to the double-spending problem using a peer-to-peer network.

The network timestamps transactions by hashing them into an ongoing chain of hashbased proof-of-work, forming a record that cannot be changed without redoing the proof-of-work.

The longest chain not only serves as proof of the sequence of events witnessed, but proof that it came from the largest pool of CPU power.

As long as a majority of CPU power is controlled by nodes that are not cooperating to attack the network, they'll generate the longest chain and outpace attackers.

The network itself requires minimal structure.

Messages are broadcast on a best effort basis, and nodes can leave and rejoin the network at will, accepting the longest proof-of-work chain as proof of what happened while they were gone.

1. Introduction

Commerce on the Internet has come to rely almost exclusively on financial institutions serving as trusted third parties to process electronic payments.

While the system works well enough for most transactions, it still suffers from the inherent weaknesses of the trust based model.

Completely non-reversible transactions are not really possible, since financial institutions cannot avoid mediating disputes.

The cost of mediation increases transaction costs, limiting the minimum practical transaction size and cutting off the possibility for small casual transactions, and there is a broader cost in the loss of ability to make non-reversible payments for nonreversible services.

With the possibility of reversal, the need for trust spreads.

Merchants must be wary of their customers, hassling them for more information than they would otherwise need.

A certain percentage of fraud is accepted as unavoidable.

These costs and payment uncertainties can be avoided in person by using physical currency, but no mechanism exists to make payments over a communications channel without a trusted party.

What is needed is an electronic payment system based on cryptographic proof instead of trust, allowing any two willing parties to transact directly with each other without the need for a trusted third party.

Transactions that are computationally impractical to reverse would protect sellers from fraud, and routine escrow mechanisms could easily be implemented to protect buyers.

In this paper, we propose a solution to the double-spending problem using a peer-to-peer distributed timestamp server to generate computational proof of the chronological order of transactions.

The system is secure as long as honest nodes collectively control more CPU power than any cooperating group of attacker nodes.

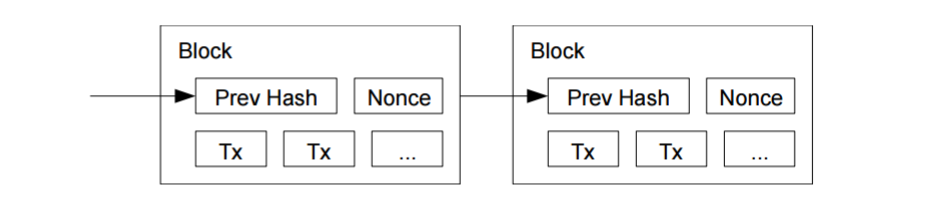

2. Transactions

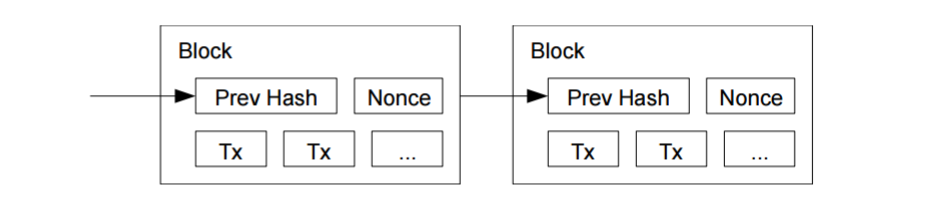

We define an electronic coin as a chain of digital signatures.

Each owner transfers the coin to the next by digitally signing a hash of the previous transaction and the public key of the next owner and adding these to the end of the coin.

A payee can verify the signatures to verify the chain of ownership.

The problem of course is the payee can't verify that one of the owners did not double-spend the coin.

A common solution is to introduce a trusted central authority, or mint, that checks every transaction for double spending.

After each transaction, the coin must be returned to the mint to issue a new coin, and only coins issued directly from the mint are trusted not to be double-spent.

The problem with this solution is that the fate of the entire money system depends on the company running the mint, with every transaction having to go through them, just like a bank.

We need a way for the payee to know that the previous owners did not sign any earlier transactions.

For our purposes, the earliest transaction is the one that counts, so we don't care about later attempts to double-spend.

The only way to confirm the absence of a transaction is to be aware of all transactions.

In the mint based model, the mint was aware of all transactions and decided which arrived first.

To accomplish this without a trusted party, transactions must be publicly announced[01], and we need a system for participants to agree on a single history of the order in which they were received.

The payee needs proof that at the time of each transaction, the majority of nodes agreed it was the first received.

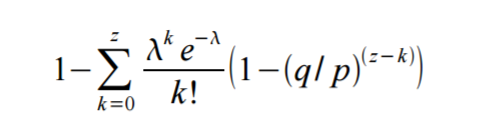

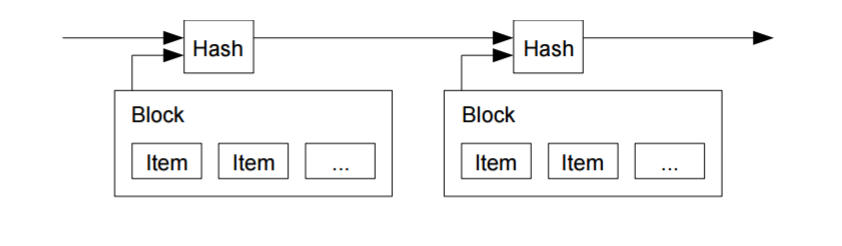

3. Timestamp Server

The solution we propose begins with a timestamp server.

A timestamp server works by taking a hash of a block of items to be timestamped and widely publishing the hash, such as in a newspaper or Usenet post[2-5].

The timestamp proves that the data must have existed at the time, obviously, in order to get into the hash.

Each timestamp includes the previous timestamp in its hash, forming a chain, with each additional timestamp reinforcing the ones before it.

4. Proof-of-Work

To implement a distributed timestamp server on a peer-to-peer basis, we will need to use a proof-of-work system similar to Adam Back's Hashcash[06], rather than newspaper or Usenet posts.

The proof-of-work involves scanning for a value that when hashed, such as with SHA-256, the hash begins with a number of zero bits.

The average work required is exponential in the number of zero bits required and can be verified by executing a single hash.

For our timestamp network, we implement the proof-of-work by incrementing a nonce in the block until a value is found that gives the block's hash the required zero bits.

Once the CPU effort has been expended to make it satisfy the proof-of-work, the block cannot be changed without redoing the work.

As later blocks are chained after it, the work to change the block would include redoing all the blocks after it.

The proof-of-work also solves the problem of determining representation in majority decision making.

If the majority were based on one-IP-address-one-vote, it could be subverted by anyone able to allocate many IPs.

Proof-of-work is essentially one-CPU-one-vote.

The majority decision is represented by the longest chain, which has the greatest proof-of-work effort invested in it.

If a majority of CPU power is controlled by honest nodes, the honest chain will grow the fastest and outpace any competing chains.

To modify a past block, an attacker would have to redo the proof-of-work of the block and all blocks after it and then catch up with and surpass the work of the honest nodes.

We will show later that the probability of a slower attacker catching up diminishes exponentially as subsequent blocks are added.

To compensate for increasing hardware speed and varying interest in running nodes over time, the proof-of-work difficulty is determined by a moving average targeting an average number of blocks per hour.

If they're generated too fast, the difficulty increases.

5. Network

The steps to run the network are as follows:

1. New transactions are broadcast to all nodes.

2. Each node collects new transactions into a block.

3. Each node works on finding a difficult proof-of-work for its block.

4. When a node finds a proof-of-work, it broadcasts the block to all nodes.

5. Nodes accept the block only if all transactions in it are valid and not already spent.

6. Nodes express their acceptance of the block by working on creating the next block in the chain, using the hash of the accepted block as the previous hash.

Nodes always consider the longest chain to be the correct one and will keep working on extending it.

If two nodes broadcast different versions of the next block simultaneously, some nodes may receive one or the other first.

In that case, they work on the first one they received, but save the other branch in case it becomes longer.

The tie will be broken when the next proof-of-work is found and one branch becomes longer; the nodes that were working on the other branch will then switch to the longer one.

New transaction broadcasts do not necessarily need to reach all nodes.

As long as they reach many nodes, they will get into a block before long.

Block broadcasts are also tolerant of dropped messages.

If a node does not receive a block, it will request it when it receives the next block and realizes it missed one.

6. Incentive

By convention, the first transaction in a block is a special transaction that starts a new coin owned by the creator of the block.

This adds an incentive for nodes to support the network, and provides a way to initially distribute coins into circulation, since there is no central authority to issue them.

The steady addition of a constant of amount of new coins is analogous to gold miners expending resources to add gold to circulation.

In our case, it is CPU time and electricity that is expended.

The incentive can also be funded with transaction fees.

If the output value of a transaction is less than its input value, the difference is a transaction fee that is added to the incentive value of the block containing the transaction. Once a predetermined number of coins have entered circulation, the incentive can transition entirely to transaction fees and be completely inflation free.

The incentive may help encourage nodes to stay honest.

If a greedy attacker is able to assemble more CPU power than all the honest nodes, he would have to choose between using it to defraud people by stealing back his payments, or using it to generate new coins.

He ought to find it more profitable to play by the rules, such rules that favour him with more new coins than everyone else combined, than to undermine the system and the validity of his own wealth.

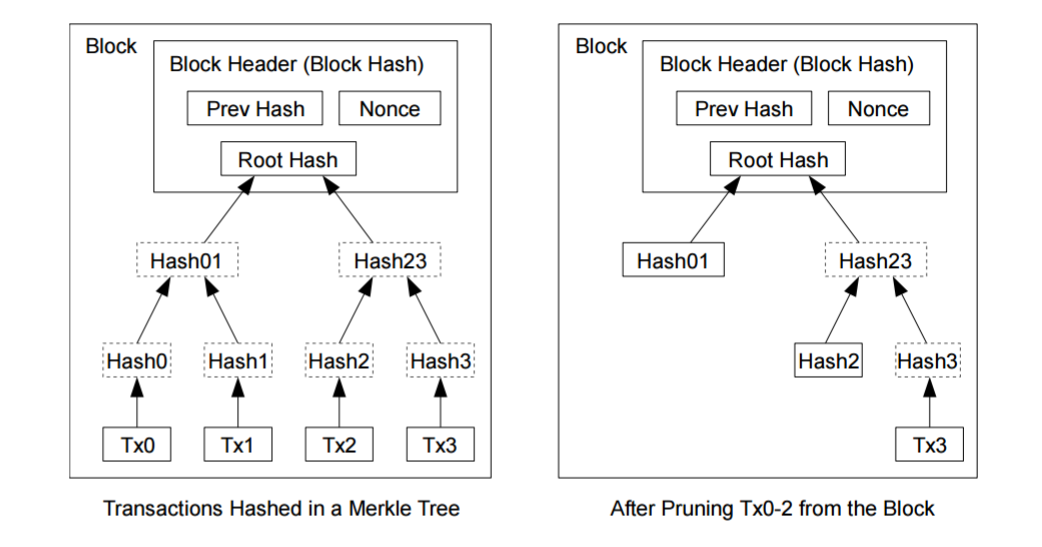

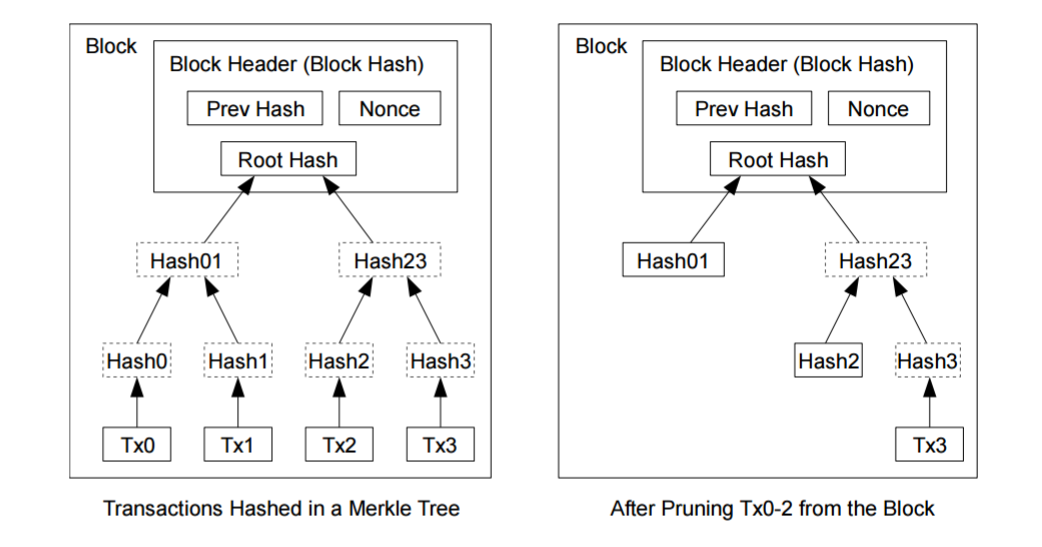

7. Reclaiming Disk Space

Once the latest transaction in a coin is buried under enough blocks, the spent transactions before it can be discarded to save disk space.

To facilitate this without breaking the block's hash, transactions are hashed in a Merkle Tree [7][2][5], with only the root included in the block's hash.

Old blocks can then be compacted by stubbing off branches of the tree.

The interior hashes do not need to be stored.

A block header with no transactions would be about 80 bytes.

If we suppose blocks are generated every 10 minutes, 80 bytes * 6 * 24 * 365 = 4.2MB per year.

With computer systems typically selling with 2GB of RAM as of 2008, and Moore's Law predicting current growth of 1.2GB per year, storage should not be a problem even if the block headers must be kept in memory.

8. Simplified Payment Verification

It is possible to verify payments without running a full network node.

A user only needs to keep a copy of the block headers of the longest proof-of-work chain, which he can get by querying network nodes until he's convinced he has the longest chain, and obtain the Merkle branch linking the transaction to the block it's timestamped in.

He can't check the transaction for himself, but by linking it to a place in the chain, he can see that a network node has accepted it, and blocks added after it further confirm the network has accepted it.

As such, the verification is reliable as long as honest nodes control the network, but is more vulnerable if the network is overpowered by an attacker.

While network nodes can verify transactions for themselves, the simplified method can be fooled by an attacker's fabricated transactions for as long as the attacker can continue to overpower the network.

One strategy to protect against this would be to accept alerts from network nodes when they detect an invalid block, prompting the user's software to download the full block and alerted transactions to confirm the inconsistency.

Businesses that receive frequent payments will probably still want to run their own nodes for more independent security and quicker verification.

9. Combining and Splitting Value

Although it would be possible to handle coins individually, it would be unwieldy to make a separate transaction for every cent in a transfer.

To allow value to be split and combined, transactions contain multiple inputs and outputs.

Normally there will be either a single input from a larger previous transaction or multiple inputs combining smaller amounts, and at most two outputs: one for the payment, and one returning the change, if any, back to the sender.

It should be noted that fan-out, where a transaction depends on several transactions, and those transactions depend on many more, is not a problem here.

There is never the need to extract a complete standalone copy of a transaction's history.

10. Privacy

The traditional banking model achieves a level of privacy by limiting access to information to the parties involved and the trusted third party.

The necessity to announce all transactions publicly precludes this method, but privacy can still be maintained by breaking the flow of information in another place: by keeping public keys anonymous.

The public can see that someone is sending an amount to someone else, but without information linking the transaction to anyone.

This is similar to the level of information released by stock exchanges, where the time and size of individual trades, the "tape", is made public, but without telling who the parties were.

As an additional firewall, a new key pair should be used for each transaction to keep them from being linked to a common owner.

Some linking is still unavoidable with multi-input transactions, which necessarily reveal that their inputs were owned by the same owner.

The risk is that if the owner of a key is revealed, linking could reveal other transactions that belonged to the same owner.

11. Calculations

We consider the scenario of an attacker trying to generate an alternate chain faster than the honest chain.

Even if this is accomplished, it does not throw the system open to arbitrary changes, such as creating value out of thin air or taking money that never belonged to the attacker.

Nodes are not going to accept an invalid transaction as payment, and honest nodes will never accept a block containing them.

An attacker can only try to change one of his own transactions to take back money he recently spent.

The race between the honest chain and an attacker chain can be characterized as a Binomial Random Walk.

The success event is the honest chain being extended by one block, increasing its lead by +1, and the failure event is the attacker's chain being extended by one block, reducing the gap by -1.

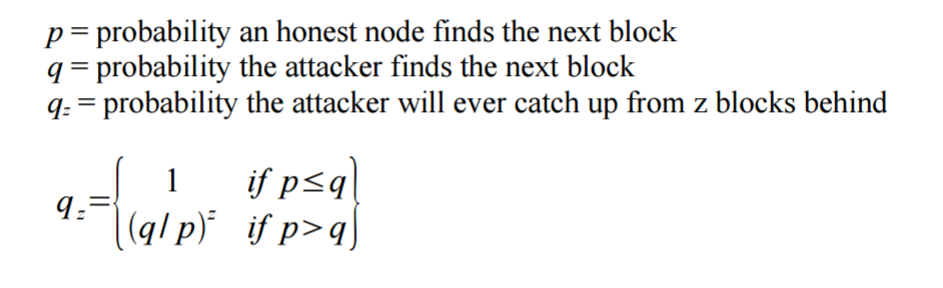

The probability of an attacker catching up from a given deficit is analogous to a Gambler's Ruin problem.

Suppose a gambler with unlimited credit starts at a deficit and plays potentially an infinite number of trials to try to reach breakeven.

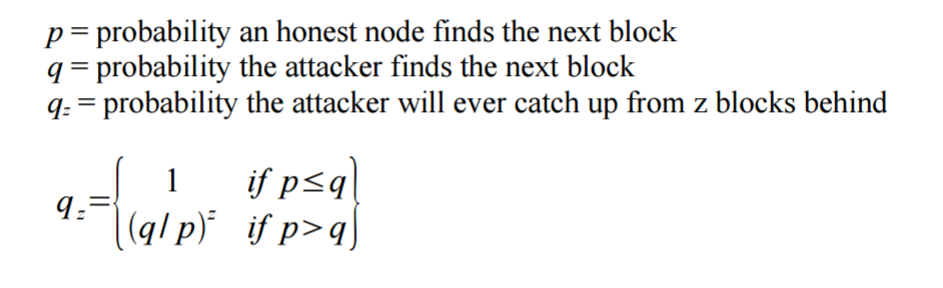

We can calculate the probability he ever reaches breakeven, or that an attacker ever catches up with the honest chain, as follows[8]:

Given our assumption that p>q, the probability drops exponentially as the number of blocks the attacker has to catch up with increases.

With the odds against him, if he doesn't make a lucky lunge forward early on, his chances become vanishingly small as he falls further behind.

We now consider how long the recipient of a new transaction needs to wait before being sufficiently certain the sender can't change the transaction.

We assume the sender is an attacker who wants to make the recipient believe he paid him for a while, then switch it to pay back to himself after some time has passed.

The receiver will be alerted when that happens, but the sender hopes it will be too late.

The receiver generates a new key pair and gives the public key to the sender shortly before signing.

This prevents the sender from preparing a chain of blocks ahead of time by working on it continuously until he is lucky enough to get far enough ahead, then executing the transaction at that moment.

Once the transaction is sent, the dishonest sender starts working in secret on a parallel chain containing an alternate version of his transaction.

Running some results, we can see the probability drop off exponentially with z.

q=0.1

z=0 P=1.0000000

z=1 P=0.2045873

z=2 P=0.0509779

z=3 P=0.0131722

z=4 P=0.0034552

z=5 P=0.0009137z=6 P=0.0002428

z=7 P=0.0000647

z=8 P=0.0000173

z=9 P=0.0000046

z=10 P=0.0000012

q=0.3

z=0 P=1.0000000

z=5 P=0.1773523

z=10 P=0.0416605

z=15 P=0.0101008

z=20 P=0.0024804

z=25 P=0.0006132

z=30 P=0.0001522

z=35 P=0.0000379

z=40 P=0.0000095

z=45 P=0.0000024

z=50 P=0.0000006

Solving for P less than 0.1%...

P < 0.001

q=0.10 z=5

q=0.15 z=8

q=0.20 z=11

q=0.25 z=15

q=0.30 z=24

q=0.35 z=41

q=0.40 z=89

q=0.45 z=340

12. Conclusion

We have proposed a system for electronic transactions without relying on trust.

We started with the usual framework of coins made from digital signatures, which provides strong control of ownership, but is incomplete without a way to prevent double-spending.

To solve this, we proposed a peer-to-peer network using proof-of-work to record a public history of transactions that quickly becomes computationally impractical for an attacker to change if honest nodes control a majority of CPU power.

The network is robust in its unstructured simplicity.

Nodes work all at once with little coordination.

They do not need to be identified, since messages are not routed to any particular place and only need to be delivered on a best effort basis.

Nodes can leave and rejoin the network at will, accepting the proof-of-work chain as proof of what happened while they were gone.

They vote with their CPU power, expressing their acceptance of valid blocks by working on extending them and rejecting invalid blocks by refusing to work on them.

Any needed rules and incentives can be enforced with this consensus mechanism.

References

[1]. W. Dai, "b-money," http://www.weidai.com/bmoney.txt, 1998.

[2]. H. Massias, X.S. Avila, and J.-J. Quisquater, "Design of a secure timestamping service with minimal trust requirements," In 20th Symposium on Information Theory in the Benelux, May 1999.

[3]. S. Haber, W.S. Stornetta, "How to time-stamp a digital document," In Journal of Cryptology, vol 3, no 2, pages 99-111, 1991.

[4]. D. Bayer, S. Haber, W.S. Stornetta, "Improving the efficiency and reliability of digital timestamping," In Sequences II: Methods in Communication, Security and Computer Science, pages 329-334, 1993.

[5]. S. Haber, W.S. Stornetta, "Secure names for bit-strings," In Proceedings of the 4th ACM Conference on Computer and Communications Security, pages 28-35, April 1997.

[6]. A. Back, "Hashcash - a denial of service countermeasure," http://www.hashcash.org/papers/hashcash.pdf, 2002.

[7]. R.C. Merkle, "Protocols for public key cryptosystems," In Proc. 1980 Symposium on Security and Privacy, IEEE Computer Society, pages 122-133, April 1980.

[8]. W. Feller, "An introduction to probability theory and its applications," 1957.

Bitcoin-prcl'implementation

name::

* McsEngl.Bitcoin-prcl'implementation,

Bitcoin-prcl'reference-implementation (link)

Bitcoin-prcl'BIP (Bitcoin-Improvement-Proposals | btcbip)

description::

People wishing to submit BIPs, first should propose their idea or document to the mailing list. After discussion they should email Greg Maxwell <gmaxwell@gmail.com>. After copy-editing and acceptance, it will be published here.

We are fairly liberal with approving BIPs, and try not to be too involved in decision making on behalf of the community. The exception is in very rare cases of dispute resolution when a decision is contentious and cannot be agreed upon. In those cases, the conservative option will always be preferred.

Having a BIP here does not make it a formally accepted standard until its status becomes Active. For a BIP to become Active requires the mutual consent of the community.

Those proposing changes should consider that ultimately consent may rest with the consensus of the Bitcoin users (see also: economic majority).

[https://github.com/bitcoin/bips#readme]

===

Bitcoin Improvement Proposals.

RFC-like documents modeled after PEPs (Python Enhancement Proposals) discussing different aspects of the protocol and software.

Most interesting BIPs describe *hard fork* changes in the core protocol that require supermajority of Bitcoin users (or, in some cases, only miners) to agree on the change and accept it in an organized manner.

[https://github.com/oleganza/bitcoin-papers/blob/master/BitcoinGlossary.md]

name::

* McsEngl.BIP-(Bitcoin-Improvement-Proposals),

* McsEngl.Bitcoin-Improvement-Proposals-(BIP),

* McsEngl.DnBitcoin'BIP-(Bitcoin-Improvement-Proposals),

* McsEngl.DnBitcoin'Bitcoin-Improvement-Proposals-(BIP),

* McsEngl.Bitcoin-prcl'BIP-(Bitcoin-Improvement-Proposals),

name.Greek::

* McsElln.Προτάσεις-Βελτίωσης-Bitcoin,

addressWpg::

* https://github.com/bitcoin/bips#readme,

Bitcoin-bip'Attribute

specific::

* Number

* Layer

* Title

* Owner

* Type

* Status

Bitcoin-prcl'lightning-network

description::

A quick overview of what the Lightning network is

- A payment layer that makes use of the script language in Bitcoin

- A way to send and spend Bitcoin across nodes instantly and irreversibly

- A layer that builds on the security of the underlying protocol, Bitcoin

[https://medium.com/@btc_coach/lightning-network-in-action-b18a035c955d]

===

The lightning network is a highly anticipated second-layer protocol to be rolled out on top of Bitcoin’s blockchain. Cleverly utilizing Bitcoin’s programmable elements (like multisignature and time-locks), lightning users should be able to make a virtually unlimited number of off-chain transactions with instant confirmations and at low cost. This should boost Bitcoin’s micropayment-ability, overall scalability and even privacy.

[https://bitcoinmagazine.com/articles/lightning-network-one-step-closer-to-reality-as-lightning-labs-announces-alpha-release-1484333955]

===

Announcing the Thunder Network Alpha Release

Peter · May 16, 2016 · Leave a Reply

At Blockchain, we’re on a mission to create an open, accessible, and equitable financial future. Since our inception, we have focused on building products that make it easy for everyday people to use bitcoin to store and transfer value all over the world. We make Bitcoin usable and useful. We’ve been able to do that because we develop with a user-focused mandate.

A faster, cheaper, and more functional network would deliver real value to our users, so we were excited by the growth of research into payment channel technology on the bitcoin network and innovative uses of this technology. We were particularly interested in the idea of using smart contracts to build what are basically super-charged payments networks, as outlined in a white paper by the lightning.network team. Last year, we hired a talented engineer, Mats Jerratsch, who had been pioneering innovation in this vertical to work with our engineering team and lead research and development on a network based around these ideas.

Lightning networks have been purely conceptual, research based, and only in test nets and labs – until now. Today, we release the alpha version of our Thunder Network, the first usable implementation of the Lightning network for off chain bitcoin payments that settles back to the main bitcoin blockchain.

We used it internally a few days ago. Click here to learn all about Transaction 0 between Mats and me.

Thunder has the potential to facilitate secure, trustless, and instant payments. It has the ability to unleash the power of microtransactions, to allow the bitcoin network to handle heavy loads, and to increase user privacy. In this Alpha version, we prove that it can be done. From a feature perspective, there is both a node and a wallet (with GUI) present. Even more importantly:

Settlement to the bitcoin blockchain

Scale: According to our tests so far, we can achieve better-than-Visa scale (100,000 TPS) with only a few thousand nodes on the network

Extremely cheap payments: fees will develop naturally, due to the free market in an open and permissionless network and will fundamentally be lower than on-chain payments

Encryption and Authentication: All communications between all nodes and wallets are encrypted using AES-CTR and take place only after completing authentication.

Seed Peers and automatically provide them with network topology using a basic gossip protocol similar to the one used in the bitcoin network, which allows complex routes over multiple hops

Payment Channels can be opened and closed at will, with transactions settling onto the bitcoin blockchain

Payment Debate: Across the route each hop will renegotiate a new status with the next hop, as a payment makes its way through the network with cryptography in place to prevent fraud

Relaying Payments: TN will relay payments over multiple nodes in the network automatically, using encrypted routing. No one knows who made a payment, allowing for more privacy

Settle payments automatically, no manual intervention needed. The settlement will ripple back through the network to provide proof-of-payment

Instant Payments that are irrevocable the moment you see them

Until both CSV and SegWit are implemented on the bitcoin blockchain, transactions are not enforceable at the bitcoin protocol level. So, the current Thunder prototype is best suited for transactions among a trusted network of users. Try this amongst your dev team or amongst your trusted internet friends, but don’t use it for real payments. Remember: this is alpha testing software.

So why release this now? We believe it is critical to get something in the hands of users as soon as possible to gain feedback that will enable us to be ready when the network is. So review it, test it out, open an issue on GitHub, or send us an email. If you want to work on tech like this full time, head here and apply to join our team.

We encourage you to find out more at:

www.blockchain.com/thunder

https://github.com/blockchain/thunder

[https://blog.blockchain.com/2016/05/16/announcing-the-thunder-network-alpha-release/]

name::

* McsEngl.DnBitcoin'thunder-network,

* McsEngl.DnBitcoin'lightning-network,

* McsEngl.Bitcoin-prcl'lightning-network,

* McsEngl.lightning-network-of-bitcoin,

addressWpg::

* https://lightning.network/,

===

* {2019-03-10} Michael-K.-Spencer, https://medium.com/blockchain-positive/what-is-the-lightning-network-e5ff861a7604,

* {2018-10-08} Saubyk, Introducing RTL — A Web UI for Lightning Network Daemon, https://medium.com/coinmonks/introducing-rtl-a-web-ui-for-lnd-d0bb0d937e91,

* {2018-04-04} Aaron-van-Wirdum, The History of Lightning: From Brainstorm to Beta: https://bitcoinmagazine.com/,

* {2018-03-15} Lightning’s First Implementation Is Now in Beta; Developers Raise $2.5M: https://bitcoinmagazine.com/,

* {2018-01-20} THE LIGHTNING NETWORK COULD MAKE BITCOIN FASTER—AND CHEAPER: SANDRA UPSON https://www.wired.com/,

* {2017-12-12} https://www.youtube.com/watch?v=rrr_zPmEiME,

* {2017-03-26} https://medium.com/@btc_coach/lightning-network-in-action-b18a035c955d#.t0xv3e8mk,

* {2016-01-14 Version-0.5.9.2} White-paper: https://lightning.network/lightning-network-paper.pdf,

* https://medium.com/@AudunGulbrands1/lightning-faq-67bd2b957d70#.gtx36kylc,

node of DnBitcoin

description::

Node:

A computer connected to the bitcoin network using a client that relays transactions to others (see client).

If you'd like to run a bitcoin node, then bitcoin.org offers a comprehensive guide.

[http://www.coindesk.com/information/bitcoin-glossary/]

===

Node, or client, is a computer on the network that speaks Bitcoin message protocol (exchanging transactions and blocks).

There are *full nodes* that are capable of validating the entire blockchain and *lightweight nodes*, with reduced functionality.

Wallet applications that speak to a server are not considered nodes.

[https://github.com/oleganza/bitcoin-papers/blob/master/BitcoinGlossary.md]

===

A computer connected to the bitcoin network using a client that relays transactions to others (see client). If you'd like to run a bitcoin node, then bitcoin.org offers a comprehensive guide.

[http://www.coindesk.com/information/bitcoin-glossary/#node]

===

A system running a Bitcoin client is called a Bitcoin node.

The Bitcoin network's function is to relay two types of messages: Transactions and blocks.

A transaction is a digitally signed instruction to transfer money between addresses, as described earlier.

A block is: A set of transactions.Apr 7, 2013

Bitcoin part 10: The network « self-evident

[https://self-evident.org/?p=999]

name::

* McsEngl.DnBitcoin'node,

* McsEngl.Bitcoin-node,

name.Greek::

* McsElln.Κόμβος-μπιτκόιν,

Bitcoin-node'Consensus

description::

When several nodes (usually most nodes on the network) all have the same blocks in their locally-validated best block chain.

[https://bitcoin.org/en/glossary/consensus]

name::

* McsEngl.DnBitcoin'consensus,

name.Greek::

* McsElln.Μπιτκόιν-συναίνεση,

Bitcoin-node.FULL

description::

A node which implements all of Bitcoin protocol and does not require trusting any external service to validate transactions.

It is able to download and validate the entire *blockchain*.

All full nodes implement the same peer-to-peer messaging protocol to exchange transactions and blocks, but that is not a requirement.

A full node may receive and validate data using any protocol and from any source.

However, the highest security is achieved by being able to communicate as fast as possible with as many nodes as possible.

[https://github.com/oleganza/bitcoin-papers/blob/master/BitcoinGlossary.md]

===

A full node is defined as a network-attached bitcoin client application, such as the original bitcoin Core (QT) client or an implementation of the bitcoind framework. A full node has the entire, up-to-date set of blockchain files, and also has port 8333 open, so it is set to listen for incoming requests. This list is very specific, and all of these conditions must be met for it to be a useful full node.

[http://bravenewcoin.com/news/the-decline-in-bitcoins-full-nodes/]

===

A full node is a program that fully validates transactions and blocks. Almost all full nodes also help the network by accepting transactions and blocks from other full nodes, validating those transactions and blocks, and then relaying them to further full nodes.

Most full nodes also serve lightweight clients by allowing them to transmit their transactions to the network and by notifying them when a transaction affects their wallet. If not enough nodes perform this function, clients won’t be able to connect through the peer-to-peer network—they’ll have to use centralized services instead.

Many people and organizations volunteer to run full nodes using spare computing and bandwidth resources—but more volunteers are needed to allow Bitcoin to continue to grow. This document describes how you can help and what helping will cost you.

[https://bitcoin.org/en/full-node#what-is-a-full-node]

===

Each full node in the Bitcoin network independently stores a block chain containing only blocks validated by that node.

[https://bitcoin.org/en/developer-guide#block-chain]

===

The Bitcoin network protocol allows full nodes (peers) to collaboratively maintain a peer-to-peer network for block and transaction exchange.

[https://bitcoin.org/en/developer-guide#term-peer]

name::

* McsEngl.DnBitcoin'full-node,

* McsEngl.DnBitcoin'peer,

addressWpg::

* https://bitcoin.org/en/full-node,

Bitcoin-nodFul'Bitcoin-Core (link)

Bitcoin-nodFul'requirements

description::

Minimum Requirements

Bitcoin Core full nodes have certain requirements. If you try running a node on weak hardware, it may work—but you’ll likely spend more time dealing with issues. If you can meet the following requirements, you’ll have an easy-to-use node.

Desktop or laptop hardware running recent versions of Windows, Mac OS X, or Linux.

50 gigabytes of free disk space

2 gigabytes of memory (RAM)

A broadband Internet connection with upload speeds of at least 400 kilobits (50 kilobytes) per second

An unmetered connection, a connection with high upload limits, or a connection you regularly monitor to ensure it doesn’t exceed its upload limits. It’s common for full nodes on high-speed connections to use 200 gigabytes upload or more a month. Download usage is around 20 gigabytes a month, plus around an additional 40 gigabytes the first time you start your node.

6 hours a day that your full node can be left running. (You can do other things with your computer while running a full node.) More hours would be better, and best of all would be if you can run your node continuously.

Note: many operating systems today (Windows, Mac, and Linux) enter a low-power mode after the screensaver activates, slowing or halting network traffic. This is often the default setting on laptops and on all Mac OS X laptops and desktops. Check your screensaver settings and disable automatic “sleep” or “suspend” options to ensure you support the network whenever your computer is running.

[https://bitcoin.org/en/full-node#minimum-requirements]

Bitcoin-node.FULL.NO (lightweight)

description::

Lightweight client

Comparing to a full node, lightweight node does not store the whole blockchain and thus cannot fully verify any transaction.

There are two kinds of lightweight nodes: those fully trusting an external service to determine wallet balance and validity of transactions (e.g. blockchain.info) and the apps implementing Simplified Payment Verification (SPV).

SPV clients do not need to trust any particular service, but are more vulnerable to a 51% attack than full nodes. See Simplified Payment Verification for more info.

[https://github.com/oleganza/bitcoin-papers/blob/master/BitcoinGlossary.md#lightweight-client]

===

A protocol known as “simplified payment verification” (SPV) allows for another class of nodes to exist, called “light nodes”, which download the block headers, verify the proof of work on the block headers, and then download only the “branches” associated with transactions that are relevant to them.

This allows light nodes to determine with a strong guarantee of security what the status of any Bitcoin transaction, and their current balance, is while downloading only a very small portion of the entire blockchain.

[https://leanpub.com/decentralizedapplicationswithethereum/read_sample]

name::

* McsEngl.DnBitcoin'light-node,

* McsEngl.Bitcoin-node.light,

* McsEngl.DnBitcoin'lightweight-client-node,

* McsEngl.DnBitcoin'lightweight-node,

Bitcoin-node.HONEST

name::

* McsEngl.DnBitcoin'honest-peer,

Bitcoin-node.HONEST.NO

description::

Take note that for both types of broadcasting, mechanisms are in place to punish misbehaving peers who take up bandwidth and computing resources by sending false information. If a peer gets a banscore above the -banscore=<n> threshold, he will be banned for the number of seconds defined by -bantime=<n>, which is 86,400 by default (24 hours).

[https://bitcoin.org/en/developer-guide#misbehaving-nodes]

name::

* McsEngl.DnBitcoin'honestNo-peer,

* McsEngl.DnBitcoin'malicious-node,

* McsEngl.DnBitcoin'misbehaving-node,

* McsEngl.DnBitcoin'untrustworthy-peer,

Bitcoin-node.MINER

description::

The bitcoin network is driven by what are called miners, specialized computers that run the bitcoin software. In exchange, the people who run these miners are automatically paid in bitcoin. That’s their immediate incentive. But they also have an interest in expanding the network and keeping it running smoothly. Otherwise, those payments will dry up.

...

As Hearn pointed out, two Chinese operations control about 50 percent of the network’s mining power, and they’re reluctant to adopt the larger block size. “[They] refuse to switch to any competing product, as they perceive doing so as ‘disloyalty’—and they’re terrified of doing anything that might make the news of a ‘split’ and cause investor panic,” he wrote. “They have chosen instead to ignore the problem and hope it goes away.”

[http://www.wired.com/2016/02/the-schism-over-bitcoin-is-how-bitcoin-is-supposed-to-work/]

===

The process of finding a valid block is called mining whereas nodes that participate in that process are called miners.

[https://github.com/minium/Bitcoin-Spec/blob/master/Bitcoin.pdf]

name::

* McsEngl.DnBitcoin'miner-node,

* McsEngl.DnBitcoin'miner,

Bitcoin-nodMnr'mining

description::

Mining infrastructure is the backbone of bitcoin. Anyone who contributes computing power to help process transactions on the network is rewarded with the chance to "mine" bitcoin.

In plain English, in return for helping keep the network up and running, they have the chance of being given a newly created piece of the digital currency.

[https://www.weforum.org/agenda/2016/06/these-photos-show-you-inside-an-icelandic-bitcoin-mine?]

===

Τα bitcoin δημιουργούνται μέσω μιας διαδικασίας που ονομάζεται «εξόρυξη» (mining), η οποία αφορά τον ανταγωνισμό για εύρεση λύσεων σε ένα μαθηματικό πρόβλημα κατά την επεξεργασία των συναλλαγών bitcoin.

Κάθε συμμετέχων στο δίκτυο bitcoin (ο καθένας δηλαδή με τη χρήση μιας συσκευής που τρέχει τη πλήρη στοίβα πρωτοκόλλου bitcoin) μπορεί να λειτουργήσει ως εξορύκτης (miner), χρησιμοποιώντας την επεξεργαστική ισχύ του υπολογιστή του για να επαληθεύει και να καταγράφει τις συναλλαγές.

Κάθε 10 λεπτά, κατά μέσο όρο, είναι σε θέση κάποιος να επικυρώσει τις συναλλαγές των τελευταίων 10 λεπτών και να ανταμειφθεί με ολοκαίνουργια bitcoin.

[Mastering Bitcoin, Adonopoulos, https://www.bitcoinbook.info/translations/el/book.pdf]

===

A decentralized mathematical and deterministic currency issuance (distributed mining)

[https://github.com/aantonop/bitcoinbook/blob/develop/ch01.asciidoc]

name::

* McsEngl.DvBTC'creating,

* McsEngl.DvBTC'issuance,

* McsEngl.DvBTC'mining,

* McsEngl.netBtc'currency-issuance,

* McsEngl.DvBTC'mining,

* McsEngl.DnBitcoin'mining,

* McsEngl.netBtc'mining,

name.Greek::

* McsElln.Εξόρυξη-μπιτκόιν,

Bitcoin-nodMnr'CLOUD-MINING

name::

* McsEngl.DnBitcoin'clound-mining,

addressWpg::

* {2016-07-02} https://cointelegraph.com/news/ hashocean-scam-victims-sign-petitions-to-fbi-hackers-to-reveal-more-scams,

“The website HashOcean.com is off-line and took with them millions of dollars from approximately 700,000 users worldwide. Since there are neither regulating institutions nor reliable sources of information, we have decided to open this channel to all users and supporters of cloud mining - people who believe in a transparent mining process. We created this petition to be able to ask the FBI and other similar institutions to trace those in charge of www.HashOcean.com - Cloud Mining. 700,000 users want their money back and the supporters of Cloud Mining deserve a reliable mining process.

If you lost money with www.HashOcean.com - Cloud Mining or you are simply a cryptocurrency supporter, please help us to raise awareness and get specialist help to trace the people responsible for HashOcean.com. Please sign the petition and forward to as many people as possible in all social medias. Let΄s unite and raise awareness as soon as possible.”

Bitcoin-node.SEED

description::

Seed Nodes

Nodes whose IP addresses are included in the Bitcoin client for use during a new installation when the normal bootstrapping process through IRC wasn't possible.

[https://en.bitcoin.it/wiki/Vocabulary#Seed_Nodes]

name::

* McsEngl.DnBitcoin'seed-node,

* McsEngl.Bitcoin-node.seed-node,

blockchain of DnBitcoin

description::

The blockchain is a record of all transactions that have occured in the Bitcoin system and is shared by every node in it.

Its main purpose is to infer a list of all unspent transaction outputs and their spending conditions.

The novelty of Bitcoin lies, among other things, in how the blockchain is structured in order to guarantee chronological ordering of transactions and prevent double-spending in a distributed network.

[https://github.com/minium/Bitcoin-Spec/blob/master/Bitcoin.pdf]

name::

* McsEngl.Bitcoin-chn-(Bitcoin-blockchain), {2015-09-13},

* McsEngl.DnBitcoin'global-database,

* McsEngl.blockchain.Bitcoin,

* McsEngl.Bitcoin-chain,

* McsEngl.Bitcoin-Bkcn, {2019-03-17},

* McsEngl.Bitcoin-blockchain,

* McsEngl.DnBitcoin'blockchain,

* McsEngl.DnBitcoin'chain,

name.Greek::

* McsElln.Μπιτκόιν-μπλοκτσέιν,

* McsElln.Μπλοκτσέιν-του-μπικόιν,

* McsElln.Παγκόσμιο-μπιτκόιν-μπλοκτσέιν,

* McsElln.Παγκόσμιο-μπλοκτσέιν-του-μπικόιν,

generic::

* Blockchain,

description::

Blockchain:

The full list of blocks that have been mined since the beginning of the bitcoin cryptocurrency.

The blockchain is designed so that each block contains a hash drawing on the blocks that came before it.

This is designed to make it more tamperproof.

To add further confusion, there is a company called Blockchain, which has a very popular blockchain explorer and bitcoin wallet.

[http://www.coindesk.com/information/bitcoin-glossary/]

description::

A block chain is a transaction database shared by all nodes participating in a system based on the Bitcoin protocol. A full copy of a currency's block chain contains every transaction ever executed in the currency. With this information, one can find out how much value belonged to each address at any point in history.

Every block contains a hash of the previous block. This has the effect of creating a chain of blocks from the genesis block to the current block. Each block is guaranteed to come after the previous block chronologically because the previous block's hash would otherwise not be known. Each block is also computationally impractical to modify once it has been in the chain for a while because every block after it would also have to be regenerated. These properties are what make double-spending of bitcoins very difficult. The block chain is the main innovation of Bitcoin.

Honest generators only build onto a block (by referencing it in blocks they create) if it is the latest block in the longest valid chain. "Length" is calculated as total combined difficulty of that chain, not number of blocks, though this distinction is only important in the context of a few potential attacks. A chain is valid if all of the blocks and transactions within it are valid, and only if it starts with the genesis block.

For any block on the chain, there is only one path to the genesis block. Coming from the genesis block, however, there can be forks. One-block forks are created from time to time when two blocks are created just a few seconds apart. When that happens, generating nodes build onto whichever one of the blocks they received first. Whichever block ends up being included in the next block becomes part of the main chain because that chain is longer. More serious forks have occurred after fixing bugs that required backward-incompatible changes.

Blocks in shorter chains (or invalid chains) are not used for anything. When the bitcoin client switches to another, longer chain, all valid transactions of the blocks inside the shorter chain are re-added to the pool of queued transactions and will be included in another block. The reward for the blocks on the shorter chain will not be present in the longest chain, so they will be practically lost, which is why a network-enforced 100-block maturation time for generations exists.

These blocks on the shorter chains are often called "orphan" blocks. This is because the generation transactions do not have a parent block in the longest chain, so these generation transactions show up as orphan in the listtransactions RPC call. Several pools have misinterpreted these messages and started calling their blocks "orphans". In reality, these blocks have a parent block, and might even have children.

Because a block can only reference one previous block, it is impossible for two forked chains to merge.

It's possible to use the block chain algorithm for non-financial purposes: see Alternative chain.

The block chain is broadcast to all nodes on the networking using a flood protocol: see Block chain download.

[https://en.bitcoin.it/wiki/Block_chain]

description::

6) The mined block is added to the "blockchain", a big, unbreakable ledger that lives on the bitcoin network and serves as a record of all transactions.

[http://www.economist.com/blogs/graphicdetail/2015/01/daily-chart-3]

description::

A public transaction ledger (the blockchain)

[https://github.com/aantonop/bitcoinbook/blob/develop/ch01.asciidoc]

description::

Blockchain is the system that bitcoin inventors devised. To understand how blockchain works requires dedicated study, but non-specialists might think of it as a publicly viewable spreadsheet that records every bitcoin transaction — who sent how much to whom (it's possible to remain fairly anonymous). Every few minutes, a "block" of new rows is added. But old blocks on the chain can't be edited. They're locked tight by theoretically unbreakable computer code.

See the most-read stories this hour >>

At least thousands of specially set up computers store a copy of the blockchain, so messing with records would require the herculean feat of infecting them all. Anyone can set up one of these computers, which work together to find inconsistencies and prevent fraud like double-spending. The people and businesses around the world who have set up these computers collect fees in exchange for authorizing transactions.

Finding applications for blockchain is wide-open territory right now. Factom, an organization in Austin, Texas, proposes using it to verify and lock down the records on mortgage contracts, with the aim of preventing some of the abuses of the mortgage meltdown, where signatures were faked and mortgage contracts went missing.

[http://www.latimes.com/business/la-fi-cutting-edge-blockchain-20150809-story.html]

description::

Blockchain:

A public ledger of all confirmed transactions in a form of a tree of all valid *blocks* (including *orphans*).

Most of the time, "blockchain" means the *main chain*, a single most *difficult* chain of blocks.

Blockchain is updated by *mining* blocks with new transactions.

*Unconfirmed transactions* are not part of the blockchain.

If some clients disagree on which chain is main or which blocks are valid, a *fork* happens.

[https://github.com/oleganza/bitcoin-papers/blob/master/BitcoinGlossary.md]

blockchain'Block

name::

* McsEngl.Bitcoin-block-(Bitcoin-block),

* McsEngl.DnBitcoin'block,

* McsEngl.DnBitcoin'block-of-transactions,

* McsEngl.DnBitcoin'blockchain'block-of-transactions,

whole::

* btc--blockchain,

generic::

* file,

description::

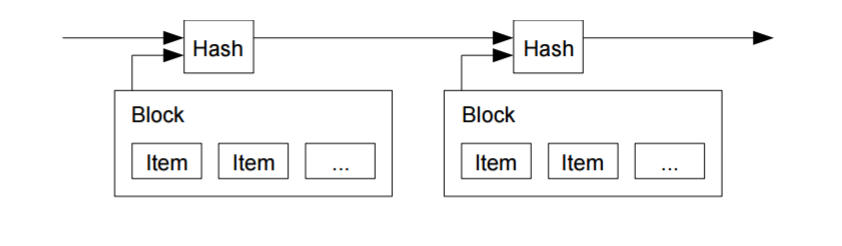

A data structure that consists of a *block header* and a *merkle tree* of transactions.

Each block (except for *genesis block*) references one previous block thus forming a tree called the *blockchain*.

Block can be though of as a group of transactions with a timestamp and a *proof-of-work* attached.

[https://github.com/oleganza/bitcoin-papers/blob/master/BitcoinGlossary.md]

===

One or more transactions prefaced by a block header and protected by proof of work.

Blocks are the data stored on the block chain.

[https://bitcoin.org/en/glossary/block]

===

Data is permanently recorded in the Bitcoin network through files called blocks.

A block is a record of some or all of the most recent Bitcoin transactions that have not yet been recorded in any prior blocks. They could be thought of like the individual pages of a city recorder's recordbook (where changes to title to real estate are recorded) or a stock transaction ledger. New blocks are added to the end of the record (known as the block chain), and can never be changed or removed once written (although some software will remove them if they are orphaned). Each block memorializes what took place in the minutes before it was created.

[https://en.bitcoin.it/wiki/Block]

block'PART

description::

Each block is composed of a header and a payload.

The header stores the current block header version (nVersion), a reference to the previous block (HashPrevBlock), the root node of the Merkle tree (HashMerkleRoot), a timestamp (nTime), a target value (nBits) and a nonce (nNonce).

Finally, the payload stores the number of transactions (#vtx ) and the vector of transactions (vtx ) included in the block.

Field name Type(Size) Description

* nVersion int(4 bytes) Block format version (currently 2),

* HashPrevBlock uint256(32 bytes) Hash of previous block header SHA2562 (nV ersion|| . . . ||nNonce),

* HashMerkleRoot uint256 (32 bytes) Top hash of the Merkle tree built from all transactions,

* nTime unsigned int (4 bytes) Timestamp in UNIX-format of approximate block creation time,

* nBits unsigned int (4 bytes) Target T for the proof of work problem in compact format. Full target value is derived as: T = 0xh2h3h4h5h6h7 * 2 8*(0xh0h1-3)

* nNonce unsigned int (4 bytes) Nonce allowing variations for solving the proof of work problem,

* #vtx VarInt (1-9 bytes) Number of transaction entries in vtx,

* vtx[ ] Transaction (Variable) Vector of transactions,

Table 3.1. Block Structure

[https://github.com/minium/Bitcoin-Spec/blob/master/Bitcoin.pdf]

block'part.HEADER (80B)

description::

Each block is composed of a header and a payload.

The header stores the current block header version (nVersion), a reference to the previous block (HashPrevBlock), the root node of the Merkle tree (HashMerkleRoot), a timestamp (nTime), a target value (nBits) and a nonce (nNonce).

Finally, the payload stores the number of transactions (#vtx ) and the vector of transactions (vtx ) included in the block.

Field name Type(Size) Description

1) nVersion int(4 bytes) Block format version (currently 2).

2) HashPrevBlock uint256(32 bytes) Hash of previous block header SHA256^2 (nV ersion|| . . . ||nNonce).

3) HashMerkleRoot uint256 (32 bytes) Top hash of the Merkle tree built from all transactions.

4) nTime unsigned int (4 bytes) Timestamp in UNIX-format of approximate block creation time.

5) nBits unsigned int (4 bytes) Target T for the proof of work problem in compact format. Full target value is derived as: T = 0xh2h3h4h5h6h7 * 2 8*(0xh0h1-3)

6) nNonce unsigned int (4 bytes) Nonce allowing variations for solving the proof of work problem.

* #vtx VarInt (1-9 bytes) Number of transaction entries in vtx,

* vtx[ ] Transaction (Variable) Vector of transactions,

Table 3.1. Block Structure

[https://github.com/minium/Bitcoin-Spec/blob/master/Bitcoin.pdf]

===

A data structure containing a previous block hash, a hash of a merkle tree of transactions, a timestamp, a *difficulty* and a *nonce*.

[https://github.com/oleganza/bitcoin-papers/blob/master/BitcoinGlossary.md]

===

An 80-byte header belonging to a single block which is hashed repeatedly to create proof of work.

[https://bitcoin.org/en/glossary/block-header]

name::

* McsEngl.Bitcoin-block'header,

* McsEngl.DnBitcoin'block-header,

nVersion (4B)

description::

The version field stores the version number of the block format.

Ever since BIP0034 [5] is in place, the block format version is 2 and blocks of any other version are neither relayed nor mined.

[https://github.com/minium/Bitcoin-Spec/blob/master/Bitcoin.pdf]

name::

* McsEngl.DnBitcoin'nVersion-of-block,

HashPrevBlock (32B)

description::

This field stores the reference to the previous block, computed as a hash over the block header as depicted in Fig. 3.1.

Figure 3.1. Block Reference Computation

A double-SHA256 hash is calculated over the concatenation of all elements in the previous block header:

SHA2562 (nVersion||HashPrevBlock||HashMerkleRoot||nTime||nBits||nNonce) (4)

The reference functions as a chaining link in the blockchain. By including a reference to the previous block, a chronological order on blocks, and thus transactions as well, is imposed.

[https://github.com/minium/Bitcoin-Spec/blob/master/Bitcoin.pdf]

name::

* McsEngl.Bitcoin-block'HashPrevBlock,

* McsEngl.DnBitcoin'HashPrevBlock,

HashMerkleRoot (32B)

description::

Merkle root:

Every transaction has a hash associated with it.

In a block, all of the transaction hashes in the block are themselves hashed (sometimes several times -- the exact process is complex), and the result is the Merkle root.

In other words, the Merkle root is the hash of all the hashes of all the transactions in the block.

The Merkle root is included in the block header.

With this scheme, it is possible to securely verify that a transaction has been accepted by the network (and get the number of confirmations) by downloading just the tiny block headers and Merkle tree -- downloading the entire block chain is unnecessary.

This feature is currently not used in Bitcoin, but it will be in the future.

[https://en.bitcoin.it/wiki/Vocabulary#Merkle_root]

===

Merkle Root

The root node of a merkle tree, a descendant of all the hashed pairs in the tree.

Block headers must include a valid merkle root descended from all transactions in that block.

[https://bitcoin.org/en/glossary/merkle-root]

===

This field stores the root of the Merkle hash tree.

It is used to provide integrity of all transactions included in the block and is computed according to the scheme described in Sect. 2.2.

The parameters used for computing the tree are double-SHA256 as the hashing algorithm and raw transactions as the data blocks (see Table 3.2 and 3.4).

[https://github.com/minium/Bitcoin-Spec/blob/master/Bitcoin.pdf]

name::

* McsEngl.Bitcoin-block'merkle-root,

* McsEngl.DnBitcoin'HashMerkleRoot,

* McsEngl.DnBitcoin'merkle-root,

Merkle-Tree

description::

Merkle Tree

A tree constructed by hashing paired data (the leaves), then pairing and hashing the results until a single hash remains, the merkle root.

In Bitcoin, the leaves are almost always transactions from a single block.